Average Cap Rate For Commercial Real Estate . A cap rate is the ratio of net operating income (noi) to the. what is the cap rate in commercial real estate? In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. our most current cap rates are 5.2% (industrial), 5.3% (multifamily), 6.4% (office), and 6.4% (retail). generally, a “good” cap rate is between 5% and 10%. the capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is. Some aggressive investors target cap rates above 8% or.

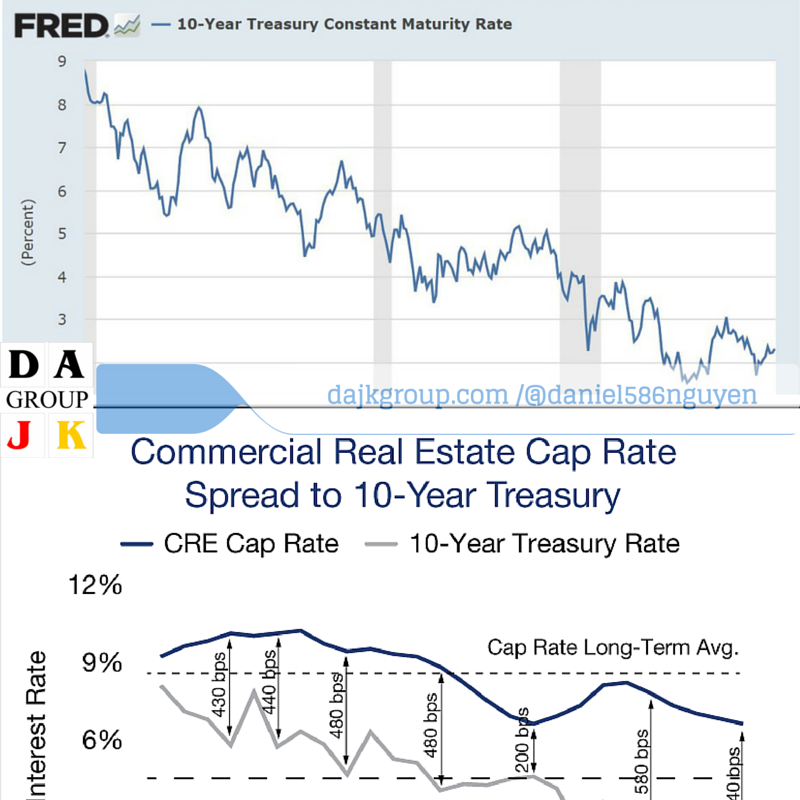

from www.dajkgroup.com

commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. what is the cap rate in commercial real estate? Some aggressive investors target cap rates above 8% or. generally, a “good” cap rate is between 5% and 10%. A cap rate is the ratio of net operating income (noi) to the. In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. our most current cap rates are 5.2% (industrial), 5.3% (multifamily), 6.4% (office), and 6.4% (retail). the capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is.

The relationship of Commercial Real Estate’s Cap Rate and Federal

Average Cap Rate For Commercial Real Estate generally, a “good” cap rate is between 5% and 10%. the capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is. commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. Some aggressive investors target cap rates above 8% or. In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. generally, a “good” cap rate is between 5% and 10%. our most current cap rates are 5.2% (industrial), 5.3% (multifamily), 6.4% (office), and 6.4% (retail). what is the cap rate in commercial real estate? A cap rate is the ratio of net operating income (noi) to the.

From www.youtube.com

Cap Rates explained in commercial real estate YouTube Average Cap Rate For Commercial Real Estate Some aggressive investors target cap rates above 8% or. A cap rate is the ratio of net operating income (noi) to the. In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. our most current cap rates are 5.2% (industrial), 5.3% (multifamily), 6.4% (office), and 6.4% (retail). what is the cap rate in commercial real estate?. Average Cap Rate For Commercial Real Estate.

From www.commercialsearch.com

2019 Cap Rates Commercial Property Executive Average Cap Rate For Commercial Real Estate what is the cap rate in commercial real estate? A cap rate is the ratio of net operating income (noi) to the. the capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is. generally, a “good” cap rate is between 5% and 10%.. Average Cap Rate For Commercial Real Estate.

From louisianacommercialrealty.com

How To Value New Orleans Commercial Real Estate Using Cap Rate Average Cap Rate For Commercial Real Estate generally, a “good” cap rate is between 5% and 10%. Some aggressive investors target cap rates above 8% or. what is the cap rate in commercial real estate? commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. A cap rate is the ratio of net operating income (noi). Average Cap Rate For Commercial Real Estate.

From propertymetrics.com

The Cap Rate What You Should Know PropertyMetrics Average Cap Rate For Commercial Real Estate Some aggressive investors target cap rates above 8% or. generally, a “good” cap rate is between 5% and 10%. the capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is. what is the cap rate in commercial real estate? In real estate, capitalization. Average Cap Rate For Commercial Real Estate.

From www.sharestates.com

The Way Forward With Cap Rate Spreads Sharestates Average Cap Rate For Commercial Real Estate commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. generally, a “good” cap rate is between 5% and 10%. the capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is. our most current. Average Cap Rate For Commercial Real Estate.

From www.youtube.com

Cap Rate Calculation Commercial Real Estate YouTube Average Cap Rate For Commercial Real Estate A cap rate is the ratio of net operating income (noi) to the. our most current cap rates are 5.2% (industrial), 5.3% (multifamily), 6.4% (office), and 6.4% (retail). commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. generally, a “good” cap rate is between 5% and 10%. Some. Average Cap Rate For Commercial Real Estate.

From www.leveragedbreakdowns.com

Cap Rates and their role in Commercial Real Estate Leveraged Breakdowns Average Cap Rate For Commercial Real Estate generally, a “good” cap rate is between 5% and 10%. commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. A cap rate is the ratio of net operating income (noi) to the. Some aggressive investors target cap rates above 8% or. our most current cap rates are 5.2%. Average Cap Rate For Commercial Real Estate.

From apartmentpropertyvaluation.com

Cap Rate Formula for Real Estate Apartment Property Valuation Average Cap Rate For Commercial Real Estate In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. the capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is. our most current cap rates are 5.2% (industrial), 5.3% (multifamily), 6.4% (office), and 6.4% (retail). generally, a “good” cap rate. Average Cap Rate For Commercial Real Estate.

From www.pinterest.com

What Is A Cap Rate? (Infographic) Real estate infographic, Real Average Cap Rate For Commercial Real Estate Some aggressive investors target cap rates above 8% or. generally, a “good” cap rate is between 5% and 10%. our most current cap rates are 5.2% (industrial), 5.3% (multifamily), 6.4% (office), and 6.4% (retail). In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. what is the cap rate in commercial real estate? A cap. Average Cap Rate For Commercial Real Estate.

From knowledge-leader.colliers.com

Quick Hits Cap Rate Spreads are Narrowing Knowledge Leader Average Cap Rate For Commercial Real Estate commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. Some aggressive investors target cap rates above 8% or. A cap rate is the ratio of net operating income (noi) to the. our most current cap rates are. Average Cap Rate For Commercial Real Estate.

From www.pinterest.com

What Is Cap Rate and How to Calculate It? Infographic What is cap Average Cap Rate For Commercial Real Estate Some aggressive investors target cap rates above 8% or. generally, a “good” cap rate is between 5% and 10%. commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. the capitalization rate (also known as cap rate). Average Cap Rate For Commercial Real Estate.

From www.worldpropertyjournal.com

Commercial Property Cap Rate Expansion Likely to Continue in 2023 Average Cap Rate For Commercial Real Estate A cap rate is the ratio of net operating income (noi) to the. what is the cap rate in commercial real estate? In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. our most current cap rates are 5.2% (industrial), 5.3% (multifamily), 6.4% (office), and 6.4% (retail). commercial real estate cap rates, a closely followed. Average Cap Rate For Commercial Real Estate.

From assetsamerica.com

Cap Rate Simplified for Commercial Real Estate + Calculator Average Cap Rate For Commercial Real Estate A cap rate is the ratio of net operating income (noi) to the. commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. our most current cap rates are 5.2% (industrial), 5.3% (multifamily), 6.4% (office), and 6.4% (retail). In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for.. Average Cap Rate For Commercial Real Estate.

From www.reit.com

Real Estate Cap Rates, Appraisals, and the Ostrich Effect Nareit Average Cap Rate For Commercial Real Estate generally, a “good” cap rate is between 5% and 10%. commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. A cap rate is the ratio of net operating income (noi) to the. the capitalization rate (also. Average Cap Rate For Commercial Real Estate.

From www.louisianacommercialrealty.com

How To Value New Orleans Commercial Real Estate Using Cap Rate Average Cap Rate For Commercial Real Estate our most current cap rates are 5.2% (industrial), 5.3% (multifamily), 6.4% (office), and 6.4% (retail). In real estate, capitalization rates—commonly called cap rates—are useful risk measurements for. what is the cap rate in commercial real estate? Some aggressive investors target cap rates above 8% or. generally, a “good” cap rate is between 5% and 10%. the. Average Cap Rate For Commercial Real Estate.

From griogairnorea.blogspot.com

18+ mortgage cap rate GriogairNorea Average Cap Rate For Commercial Real Estate generally, a “good” cap rate is between 5% and 10%. A cap rate is the ratio of net operating income (noi) to the. what is the cap rate in commercial real estate? the capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is.. Average Cap Rate For Commercial Real Estate.

From www.reit.com

Property Prices and Cap Rates in a Rising Interest Rate Environment Average Cap Rate For Commercial Real Estate commercial real estate cap rates, a closely followed measure of overall return and a convenient property valuation metric,. the capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is. A cap rate is the ratio of net operating income (noi) to the. what. Average Cap Rate For Commercial Real Estate.

From andersonadvisors.com

How Do You Calculate a Cap Rate on a Rental Property? Average Cap Rate For Commercial Real Estate the capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is. what is the cap rate in commercial real estate? A cap rate is the ratio of net operating income (noi) to the. generally, a “good” cap rate is between 5% and 10%.. Average Cap Rate For Commercial Real Estate.